263, 263-Revision of orders prejudicial to revenue, AY 2013-14, In Favour of Assessee, Kolkata tribunal

When CIT can pass order u/s 263 by holding that the order passed by the AO is erroneous and prejudicial to the interest of the Revenue? ITAT KOLKATA passed the order on 6th Jan 2021 in the case of RUNGTA MINES LTD. vs. PCIT?

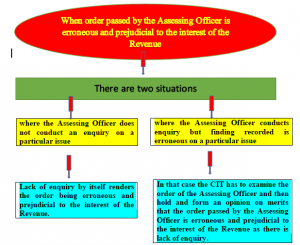

The question of substance here is that Whether an order passed under section 263 of the act would be considered as bad in law when CIT holds and forms an opinion that the order passed by assessing officer is erroneous and prejudicial to the interest of revenue without examining the order of assessing officer on merits, on the ground that the Assessing Officer conducts enquiry but finding recorded is erroneous during assessment proceeding. It can be answered in following diagram

A distinction must be drawn in the cases where the Assessing Officer does not conduct an enquiry; as lack of enquiry by itself renders the order being erroneous and prejudicial to the interest of the Revenue and cases where the Assessing Officer conducts enquiry but finding recorded is erroneous and which is also prejudicial to the interest of the Revenue. In latter cases, the CIT has to examine the order of the Assessing Officer on merits or the decision taken by the Assessing Officer on merits and then hold and form an opinion on merits that the order passed by the Assessing Officer is erroneous and prejudicial to the interest of the Revenue. In the second set of cases, CIT cannot direct the Assessing Officer to conduct further enquiry to verify and find out whether the order passed is erroneous or not.”

Once the ld. CIT initiates the proceedings u/s 263 of the Act for specific reasons and these reasons are met by the assessee, then it is incumbent upon the ld. CIT to himself independently deal with the objections and record his own satisfaction to prove that the AO’s order is in fact erroneous and prejudicial to the interests of the Revenue for the reasons out in the SCN. The ld. CIT in such a situation cannot merely set aside the assessment order directing AO to pass the order of assessment afresh, effectively giving the AO a second innings without establishing that the initial order was erroneous as well as prejudicial to the interests of the Revenue.

RUNGTA MINES LTD. vs. PRINCIPAL COMMISSIONER OF INCOME TAX

IN THE ITAT KOLKATA BENCH ‘C’

- SUDHAKAR REDDY, AM & MADHUMITA ROY, JM.

ITA No. 1326/Kol/2018 Jan 6, 2021

Section 263, 37(1) AY 2013-14

Decision in favour of: Assessee

Cases Referred to

CIT v. Madras Refineries Ltd. [2004]266 ITR 170

Sri Venkata Satyanarayna Rice Mill Contractors Co. v. CIT [1997] 223 ITR 101

Hindustan Petroleum Corporation Ltd Vs DC IT [(2005) 96 ITD 186 (Bom)]

CIT Vs Vatika Townships Pvt Ltd [(2014) 367 ITR 466 (SC)]

ITO vs DG Housing Projects Ltd in 343ITR 329

DIT vs Jyoti Foundation reported in 357 ITR 388 (Del)

CIT vs Ashish Rajpal reported in 320 ITR 674 (Del)

CIT vs R.K. Construction Co. reported in 313 ITR 65 (Guj)

CIT vs. Travancore Cochin Chemicals Ltd. 243 ITR 284 (Ker.)

CIT vs. Rajasthan Spg. & Wvg Mills Ltd. 281 ITR 408 (Raj.)

CIT vs. Coats Vijella India Ltd. 253 ITR 667 (Mad.)

Counsel appeared:

Subash Agarwal, Adv. for the Assessee.: Vijay Shankar, CIT for the Respondent

- SUDHAKAR REDDY, AM.

- This is an appeal filed by the assessee directed against the order of the Learned Pr. Commissioner of Income Tax-1, Kolkata, [hereinafter the “Pr. CIT”], passed u/s. 263 of the Income Tax Act, 1961 (the ‘Act’), dated 19.12.2017 revising the assessment order passed u/s 143(3) of the Act for the Assessment Year 2013-14 by the DCIT, Central Circle-1(3), Kolkata.

- There is a delay of 70 days in filing of the appeal. After perusing the petition for condonation and accompanying affidavit, we condone the delay and admit the appeal.

- We have heard Sri Subash Agarwal, ld. Counsel for the assessee and Sri Vijay Shankar, the ld. D/R at length. On a careful consideration of the facts and circumstances of the case, perusing of the papers on record and the orders of the authorities below we hold as follows.

- The reason for revision of the assessment order passed u/s 143(3) of the Act, as given by the Pr. CIT-1, Kolkata, is reflected in para 2 of the show cause notice issued u/s 263 of the Act on 27.11.2017. This is extracted for ready reference:

“2. On examination of the assessment record of the above mentioned assessment order, I have found that you have claimed an expenditure of Rs.16,91,78,188.25 towards corporate social responsibility expenses consisting of following expenses:

Details of Corporate Social Responsibility Expenses for the Year 2012-13:

Health Care & Water 3,14,46,510.00

Promoting Education 2,89,24,938.00

Environmental Protection 1,31,20,296.00

Rural Development near Mines 9,56,86,444.25

16,91,78,188.25

On going through the entire assessment record, I have found that the AO has only called for the details of these expenses. But he has not enquired into the nature of these expenses to determine allowability of these expenses u/s 37(1) of the Income Tax Act after finding out whether these expenses were incurred wholly and exclusively for the purpose of the business of the assessee company. Therefore, without determining the incurred allowability of these expenses, they have been found to be wrongly allowed u/s 37(1) of the Income Tax Act.”

4.1. After consideration of the explanation given by the assessee, the Pr. CIT-1, Kolkata at para 4 of his order stated the following facts:

- a) The Courts have allowed expenditure incurred on running of school and other social activities after considering the fact that the employees of the assessee were sending their children to the schools or they were getting benefitted from the social activities for which necessary financial assistance was provided by the assessee in those cases.

- b) The AO has obtained head-wise bifurcation of expenditure incurred by the assessee towards Corporate Social Responsibility but the details have not been verified.

- c) In these proceedings u/s 263 of the Act, the assessee furnished all the details.

- d) Amendment by way of Explanation 2 to Section 37(1) of the Act was w.e.f. 01.04.2015 and does not apply to the impugned assessment year.

- e) The allowability of expenditure depends only upon the nature of the expenditure.

- f) The expenditure can be allowed u/s 37(1) of the Act when the assessee is able to establish that the expenditure is incurred wholly and exclusively for the purpose of business.

4.2. He concluded that the AO during the course of assessment proceedings has not made any examination of the nature of the expenditure incurred under the head “Corporate Social Responsibility” and had allowed the same, which resulted in the order passed u/s 143(3) of the Act being erroneous to the extent it is prejudicial to the interest of the Revenue.

4.3. Thereafter at para 5, he set aside the matter to the file of the AO with the direction to the AO to verify each and every expenditure incurred under the head “Corporate Social Responsibility” and examine whether the expenditure should be allowed u/s 37(1) of the Act or not.

4.4. The ld. Counsel for the assessee pointed out that the AO had called for the details of each and every expenditure and examined the same during the course of original assessment proceedings. He pointed out to the details called for by the AO, by way of notice u/s 142(1) of the Act on 30.06.2015, wherein at point no. 13(x), the details of corporate social responsibility was called for. He filed copies of the replies filed by the assessee before the AO to prove his point that the AO has called for not only the break up, but also the details of each and every expenditure. We find from this question and reply that this is a case where the AO has examined this explanation during original assessment proceedings and has accepted the claim of the assessee. Thus in our view, this is not a case of lack of enquiry or non-application of mind by the AO to the issue on hand. The AO has taken a possible view.

4.5. The directions of the Pr. CIT to the AO, to allow only those expenditure which directly benefitted the assessee, even though they are incurred to fulfil the conditions imposed by the Companies Act under corporate social responsibility is against the propositions of law laid down by various Courts and Tribunals.

4.6. The Tribunal in the case of Bengal NRI Complex Ltd. vs. DCIT in ITA No. 2231/Kol/2017 order dated 30.11.2018 at para 4 and 5 is held as under:

“4. We have heard rival submissions and gone through the facts and circumstances of the case. We note that the AO after taking note that the assessee had debited under the head ‘CSR’ an amount of Rs.39,06,724/-, asked the assessee as to why the amount should not be disallowed because, according to him, this expenditure is not wholly and exclusively for the purpose of the assessee’s business. Pursuant to this query of the AO, the assessee explained that the payments under the head ‘CSR’ were made primarily to an institute for the purpose of vocational training provided to some individuals who are neither related nor in the payroll of the assessee company and the expenditure was part of the ‘CSR’ expenditure as envisaged u/s. 135 of the Companies Act, 2013. However, the AO did not agree to the claim of expenditure and disallowed the same. On appeal, the Ld. CIT(A) also concurred with the AO. We note that the genuineness of the expenditure made by assessee on account of ‘CSR’ which is mandatory as per sec. 135 of the Companies Act, 2013 was not doubted by the AO/Ld. CIT(A). However, the claim was disallowed only on the ground that the expenditure is not wholly and exclusively incurred for the purpose of the business the expenditure. The Ld. AR drew our attention to the coordinate Bench decision in ACIT Vs. Jindal Power Ltd. (ITAT Raipur) in ITA No.99/BLPR/2012 for AY 2008-09 dated 23.06.2016 wherein on similar facts and law, the Tribunal while allowing the expenditure under ‘CSR’ held as under:

“ii) The concept of business is not static. It has evolved over a period of time to include within its fold the concrete expression of care and concern for the society at large and the locality in which business is located in particular. Being a good corporate citizen brings goodwill of the local community as also with the regulatory agencies and society at large, thereby creating an atmosphere in which the business can succeed in a greater measure with the aid of such goodwill (CIT v. Madras Refineries Ltd. [2004]266 ITR 170, Sri Venkata Satyanarayna Rice Mill Contractors Co. v. CIT [1997] 223 ITR 101, Hindustan Petroleum Corporation Ltd Vs DC IT [(2005) 96 ITO 186 (Bom)]

(iii) The amendment in the scheme of Section 37(1), which has been introduced with effect from 1st April 2015, cannot be construed as to disadvantage to the assessee in the period prior to this amendment. This disabling provision, as set out in Explanation 2 to Section 37(1), refers only to such corporate social responsibility expenses as under Section 135 of the Companies Act, 2013, and, as such, it cannot have any application for the period not covered by this ‘statutory provision which itself came into existence in 2013. Explanation 2 to Section 37(1) is, therefore, inherently incapable of retrospective application any further. In any event, as held by Hon’ble Supreme Court’s five judge constitutional bench’s landmark judgment, in the case of CIT Vs Vatika Townships Pvt Ltd [(2014) 367 ITR 466 (SC)], the legal position in this regard has been very succinctly summed up by observing that “Of the various rules guiding how legislation has to be interpreted, one established rule is that unless a contrary intention appears, legislation is presumed not to be intended to have a retrospective operation. The idea behind the rule is that a current law should govern current activities. Law passed today cannot apply to the events of the past. If we do something today, we do it keeping in view the law of today and in force and not tomorrow’s backward adjustment of it. Our belief in the nature of the law is founded on the bed rock that every human being is entitled to arrange his affairs by rely on the existing law and should not find that his plans have been retrospectively upset. This principle of law is known as lex prospicit non respicit: law looks forward not backward.

(iv) It may appear to be some kind of a dichotomy in the tax legislation but the well settled legal position is that when a legislation confers a benefit on the taxpayer by relaxing the rigour of pre-amendment law, and when such a benefit appears to have been the objective pursued by the legislature, it would a purposive interpretation giving it a retrospective effect but when a tax legislation imposes a liability or a burden, the effect of such a legislative provision can only be prospective. We have also noted that the amendment in the scheme of Section 37(1) is not specifically stated to be retrospective and the said Explanation is inserted only with effect from 1st April 2015. In this view of the matter also, there is no reason to hold this provision to be retrospective in application. As a matter of fact, the amendment in law, which was accompanied by the statutory requirement with regard to discharging the corporate social responsibility, is a disabling provision which puts an additional tax burden on the assessee in the sense that the expenses that the assessee is required to incur, under a statutory obligation, in the course of his business are not allowed deduction in the computation of income. This disallowance is restricted to the expenses incurred by the assessee under a statutory obligation under section 135 of Companies Act 2013, and there is thus now a line of demarcation between the expenses incurred by the assessee on discharging corporate social responsibility under such a statutory obligation, and under a voluntary assumption of responsibility. As for the former, the disallowance under Explanation 2 to Section 37(1) comes into play, but, as for latter, there is no such disabling provision as long as the expenses, even in discharge of corporate social responsibility on voluntary’ basis, can be said to be “wholly and exclusively for the purposes of business”. There is no dispute that the expenses in question are not incurred under the aforesaid statutory obligation. For this reason also, as also for the basic reason that the Explanation 2 to Section 37(1) comes into play with effect from 1st April 2015, we hold that the disabling provision of Explanation 2 to Section 37(1) does not apply on the facts of this case.”

- Respectfully following the ratio laid by the Coordinate bench of this Tribunal, we note that since the ‘CSR’ expenses are mandatory for companies incorporated as per the Companies Act, 2013 and the expenditure have been incurred by the assessee as envisaged under the Companies Act, 2013. So we are of the opinion that it has to be allowed and we take note that the Tribunal in Jindal Power Ltd., (supra), has already held that the introduction of explanation 2 to sec. 37(1) of the Act w.e.f. from 1st August, 2015 cannot be held to be retrospective in operation. Therefore, the expenditure incurred by assessee on account of’CSR’ as envisaged u/s. 135 of the Companies Act, 2013 need to be allowed as deduction. Therefore, the ‘CSR’ expenditure which the assessee company was obliged to discharge because it was a statutory obligation upon the assessee company so, the deduction should have been allowed as per the law in force for this assessment year and we direct the AO to allow the expenditure. Therefore, the appeal of assessee is allowed.”

4.7. Similarly the ‘A’ Bench of the Tribunal in the case of Eveready Industries India Ltd. vs. Pr. CIT in ITA No. 805/Kol/2019 order dated 13.12.2019 at para 15 to para 20 held as follows:

“15. Coming to the expression in Explanation -2 “in the opinion of the Ld. CIT”, it must be the considered opinion of the CIT which is based on the correct facts and in accordance with the principles of law. It cannot be an arbitrary opinion bereft of facts or law. The aforesaid clause only provides for situation where inquiries or verifications should be made by reasonable and prudent officer in the context of the case. Such clause cannot be read to authorize or give unfettered powers to the Commissioner to revise each and every assessment order. The applicability of the clause is thus essentially contextual. It has to be the opinion of a prudent person properly instructed in law. The Hon’ble Supreme Court in Maneka Gandhi Vs. Union of India reported in 1978 AIR (SC) 597 has laid down the law that a public authority should discharge his duties in a fair, just and reasonable, manner and the principle of due process of law was recognized by the Hon’ble Supreme Court. Therefore the opinion of the Ld. CIT has to be in consonance with that of the well settled judicial principles and cannot be arbitrarily made discarding the judicial precedent on the subject. The opinion of the Ld. Pr. CIT has to be reasonable and that of a prudent person instructed in law and which founded on the correct facts borne out from records. The CIT’s opinion should be based on objective consideration of material facts and not on his subjective notions of the facts wrongly presumed or inferred by him. Moreover, it has to be kept in mind that an Explanation to substantive section should be read as to harmonize with and clear up any ambiguity in the main section and should not be so construed as to widen the ambit of the section conferring powers or authority larger than what is envisaged in the principal provision. It is so held by the Hon’ble Supreme Court in Bihta Cooperative Development Cane Marketing Union Ltd. Vs. Bank of Bihar, AIR 1967 SC 389 and M/s. Oblum Electrical Industries Pvt. Ltd., Hyderabad vs. Collector of Customs, Bombay – AIR 1997 SC 3467 at page 3471 and also see Justice G. P. Singh, Principal of Statutory Interpretation 234 Lexus 2016. It has to be kept in mind that while the Commissioner is exercising his revisional jurisdiction over the assessment order, he has to exercise his power in an objective manner and not arbitrarily or subjectively since he is discharging quasi-judicial powers vested in him while doing so. Thus according to us, Explanation (2) inserted by the Parliament u/s. 263 cannot override the main section i.e. sec. 263(1) of the Act. The Ld. CIT can exercise his revisional jurisdiction in the event the assessment order is erroneous as well as prejudicial to the interest of the Revenue as discussed above and not otherwise.

- In the instant case we find that in the SCN, the Ld. Pr. CIT set out seven specific reasons for which he had considered the AO’s order to be erroneous in so far as prejudicial to the interests of the Revenue. We also note that in response, the assessee had submitted before the Ld. Pr. CIT detailed explanations supported by tangible documentary evidence to prove that the SCN had proceeded on assumption of some incorrect facts and wrong interpretation of applicable legal provisions. The assessee also explained with cogent material that before completion of assessment, the AO had indeed made enquiries with reference to specific issues raised in the SCN and the order u/s 143(3) of the Act was passed only after considering the outcome of the enquiry. According to Ld. AR, on receipt of the objections from the assessee, the Ld. Pr. CIT ought to have examined the assessment records and conducted his own enquiry and thereafter should have recorded his own finding proving that the explanations furnished by the assessee suffered from any factual or legal infirmity and because of which he found that the view adopted by the AO was unsustainable in law making his order as erroneous within the meaning of Section 263 of the Act. In our opinion, once the ld. CIT initiates the proceedings u/s 263 of the Act for specific reasons and these reasons are met by the assessee, then it is incumbent upon the ld. CIT to himself independently deal with the objections and record his own satisfaction to prove that the AO’s order is in fact erroneous and prejudicial to the interests of the Revenue for the reasons out in the SCN. The ld. CIT in such a situation cannot merely set aside the assessment order directing AO to pass the order of assessment afresh, effectively giving the AO a second innings without establishing that the initial order was erroneous as well as prejudicial to the interests of the Revenue. In this regard, it is pertinent to refer to the observations and the decision rendered by the Hon’ble Delhi High Court in the case of ITO vs DG Housing Projects Ltd in 343ITR 329, which is reproduced below:

“19. In the present case, the findings recorded by the Tribunal are correct as the CIT has not gone into and has not given any reason for observing that the order passed by the Assessing Officer was erroneous. The finding recorded by the CIT is that “order passed by the Assessing Officer may be erroneous”. The CIT had doubts about the valuation and sale consideration received but the CIT should have examined the said aspect himself and given a finding that the order passed by the Assessing Officer was erroneous. He came to the conclusion and finding that the Assessing Officer had examined the said aspect and accepted the respondent’s computation figures but he had reservations. The CIT in the order has recorded that the consideration receivable was examined by the Assessing Officer but was not properly examined and therefore the assessment order is “erroneous”. The said finding will be correct, if the CIT had examined and verified the said transaction himself and given a finding on merits. As held above, a distinction must be drawn in the cases where the Assessing Officer does not conduct an enquiry; as lack of enquiry by itself renders the order being erroneous and prejudicial to the interest of the Revenue and cases where the Assessing Officer conducts enquiry but finding recorded is erroneous and which is also prejudicial to the interest of the Revenue. In latter cases, the CIT has to examine the order of the Assessing Officer on merits or the decision taken by the Assessing Officer on merits and then hold and form an opinion on merits that the order passed by the Assessing Officer is erroneous and prejudicial to the interest of the Revenue. In the second set of cases, CIT cannot direct the Assessing Officer to conduct further enquiry to verify and find out whether the order passed is erroneous or not.”

- The above view is also supported by the following decisions:

– DIT vs Jyoti Foundation reported in 357 ITR 388 (Del)

– CIT vs Ashish Rajpal reported in 320 ITR 674 (Del)

– CIT vs R.K. Construction Co. reported in 313 ITR 65 (Guj)

- Having broadly discussed and set out above the settled judicial principles for usurpation of jurisdiction u/s 263 of the Act, we now proceed to examine whether for the reasons set out in clauses (a) to (g) of the SCN, the Ld. Pr. CIT was able to justify his finding in the impugned order that the AO’s order was indeed erroneous and prejudicial to the interests of the Revenue necessitating his interference u/s 263 of the Act with reference to each of the seven issues set out in the SCN.

- In Ground Nos. 3 & 4 the assessee objected to Ld. Pr. CIT’s finding with reference to reasons set out in Clause 3(a) of the SCN which read as under:

“One of the reasons for selection of scrutiny was mismatch in turnover. It is noticed from reply of assesse dated 16-12-2016 that receipts against deduction of TDS was disclosed at Rs.9.72 Crs. However, as per accounts there were three categories of revenue earned by the assesse e during the year viz. (i) sales of products (Sch. 18a of P&L account), (ii) sales of scrap (Sch. 18b of P&L account), and (iii) other income (Sch. 19 of P&L account). Hence, incidence of TDS can apply only to other income, which as per the accounts was to the tune of Rs. 8.40 Crores (Rs. 873.53L less foreign exchange gain of Rs. 33.82L). Thus, even if TDS was deducted on entire other income, there was a short credit income. The same was not properly verified by the A. O.”

- In the impugned order the Ld. Pr. CIT admitted that the assessee had filed explanation but the same was not rejected summarily on the ground that the issue was not looked into nor were full facts discussed. In the course of hearing, the ld. AR drew our attention to the facts available on record which factually disproved the reasons set out in clause (a). As noted in Para 3, we find that the assessee’s case was selected for scrutiny under CASS inter alia on the ground that there was a mismatch in turnover as per audit report and ITR. We note that this aspect was specifically enquired into by the AO at the time of assessment. The assessee by its letter dated 09.12.2016 [Pages 17 to 21 of paper book] had brought to the AO’s attention that in fact there was no mismatch in turnover. The Ld. AR brought to our attention that in Part A of the return of income, the assessee had reported it’s Turnover at Rs.1153.407 crores which matched fully with the net sales/ turnover figure which appeared on Page 37 of the annual printed accounts. From these figures, we note that the CASS reason was examined by the AO and did not find any factual infirmity in the assessee’s explanation. Nor any falsity was found by the Ld PCIT in the impugned order.”

- Applying the propositions of law laid down in the above referred case law to the facts of this case, we hold that it is not a case of lack of enquiry. The allegation is only of inadequate enquiry, which cannot be a ground for revision u/s 263 of the Act. Thus on this ground the order passed u/s 263 of the Act is bad in law. The AO had examined the issue and taken a possible view.

5.1. In addition to the case law cited above, the direction of expenditure incurred for the benefit of the assessee is allowable u/s against the propositions of law laid down in the following cases:

- a) CIT vs. Travancore Cochin Chemicals Ltd. 243 ITR 284 (Ker.)

- b) CIT vs. Rajasthan Spg. & Wvg Mills Ltd. 281 ITR 408 (Raj.)

- c) CIT vs. Coats Vijella India Ltd. 253 ITR 667 (Mad.)

5.2. Applying the propositions of law laid down in the decision of the Tribunal in Pr. CIT that only 37(1) of the Act is Bengal NRI Complex Ltd. (supra), we have to hold that the expenditure incurred by the assessee to fulfil the obligations of Section 135 of Companies Act, 2013 is allowable as Assessment Year: 2013-14 Rungta Mines Ltd. deduction and consequently there is no error in the order passed by the AO u/s 143(3) of the Act much less an error which is prejudicial to the interest of the Revenue.

- In view of the above discussion, we quash the order of the Pr. CIT passed u/s 263 of the Act as bad in law.

- In the result, the appeal filed by the assessee is allowed.