![]()

Madras High Court

M/S.Kone Elevators (India) Pvt. … vs ACIT… on 16 June, 2021

W.P.No.43662 of 2016

Conclusion

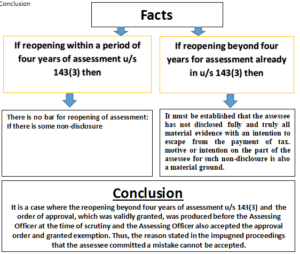

Section 147, 148, 143(3). If reopening within a period of four years of assessment u/s 143(3) then there is no bar for reopening of assessment If there is certain non-disclosure. But If reopening beyond four years for assessment already in u/s 143(3) then It must be established that the assessee has not disclosed fully and truly all material evidence with an intention to escape from the payment of tax. motive or intention on the part of the assessee for such non-disclosure is also a material ground. It is a case where the reopening beyond four years of assessment u/s 143(3) and the order of approval, which was validly granted, was produced before the Assessing Officer at the time of scrutiny and the Assessing Officer also accepted the approval order and granted exemption. Thus, the reason stated in the impugned proceedings that the assessee committed a mistake cannot be accepted. M/S.Kone Elevators (India) Pvt. … vs ACIT Madras High Court … on 16 June, 2021

Kindly see para 15 and 16

15.Question may arise, if certain non-disclosure can be a ground for reopening. In this regard, absolutely there is no bar for reopening of assessment within a period of four years under Section 147 of the Act and if the reopening of assessment is to be made beyond four years, then it must be established that the assessee has not disclosed fully and truly all material evidence with an intention to escape from the payment of tax. Mere non- disclosure is insufficient in view of the fact that the assessee may have certain opinions in the matter of furnishing certain details to the Assessing Officer. Therefore, the motive or intention on the part of the assessee for such non-disclosure is also a material ground to be considered by the Courts as well as by the authority at the time of reopening of assessment beyond the period of four years.

16.In respect of the case on hand, undoubtedly, the assessee had not submitted the ratification certificate to be obtained from the CBDT for claiming exemption under Section 10B of the Act. However, there are certain confusions even within the Department Officials regarding production of such ratification certificate from the CBDT. The dispute arises in view of the fact that the assessee is of an opinion that the approval granted by the STPI under the delegated powers of the Directors of STPI by IMSC is a valid approval for the purpose of claiming exemption under Section 10B of the Act. Therefore, the presumption cannot be construed as suppression on the part of the assessee. It is not a mere presumption in the present case by the assessee. The presumption has got a valid reason because the assessee is holding a valid approval obtained from the STPI and the power to grant approval was delegated to the Directors of STPI by IMSC. It is not as if the assessee claimed exemption under Section 10B without any such approval. It is a case where the order of approval, which was validly granted, was produced before the Assessing Officer at the time of scrutiny and the Assessing Officer also accepted the approval order and granted exemption. Thus, the reason stated in the impugned proceedings that the assessee committed a mistake cannot be accepted. The assessee was possessing a valid approval which was produced before the Assessing Officer and if a ratification is to be obtained, then the Assessing Officer, at the time of scrutiny, ought to have directed the assessee to get any such ratification certificate for the purpose of grant of exemption under Section 10B which the Department had not done. Thus, it was a mistake or omission committed by the Assessing Officer at the time of passing of the original assessment order. Even in such cases, if the reopening of assessment is made within a period of four years, then there is a ground for the Department to reopen the same. However, in the present case, the reopening of assessment is made beyond the period of four years and therefore, the statutory requirement contemplated under Section 147 is to be complied with scrupulously. Thus, the ground taken for reopening of assessment that the assessee has not disclosed fully and truly all material facts is not established in the present case and the assessee, in fact, submitted all the particulars regarding the approval granted by the authority and further ratification, if required, must be instructed by the Department which was not done and therefore, there was no suppression or non- disclosure of material facts by the assessee. Thus, the initiation of proceedings under Section 147 of the Act, beyond the period of four years, is not sustainable and consequently, the impugned proceedings are not in consonance with the conditions stipulated in the Proviso to Section 147 of the Act.

17.Accordingly, the impugned order dated 15.11.2016, passed by the respondent-Department is quashed and the writ petition stands allowed. No costs. Consequently, connected miscellaneous petition is closed.

ORDER

IN THE HIGH COURT OF JUDICATURE AT MADRAS

DATED : 16.06.2021

CORAM

THE HONOURABLE MR.JUSTICE S.M. SUBRAMANIAM

W.P.No.43662 of 2016

and

W.M.P.No.37479 of 2016

M/s.Kone Elevators (India) Pvt. Limited, -VS- Assistant Commissioner of Income-tax,

Rep., by its Director, Sri C.V.S.Krishna Kumar, Corporate Circle-4(2),

50-55, Vanagaram Road, Ayanabakkam, 121, Mahatma Gandhi Road,

Chennai-600 095 Chennai-600 034.

Petitioner Respondent

Petition filed under Article 226 of the Constitution of India praying for issuance of Writ of Certiorari to call for the records in F.No.280/AAACN2567P/ACIT, CC-4(2)/2016-17 dated 15.11.2016 on the file of the respondent relating to the A.Y. 2009-10 and quash the same.

For Petitioner : Mr.G.Baskar

For Respondent : Mr.Prabhu Mukunth Arunkumar, Standing Counsel

W.P.No.43662 of 2016

ORDER

The order passed by the respondent, rejecting the reasons furnished for reopening of assessment in proceedings dated 15.11.2016, is under challenge in the present writ petition.

2.The petitioner is an assessee engaged in the business of design, manufacture, supply, erection and installation of lifts and supply, erection and installation of escalators. It is engaged in manufacture and export of computer software which is a 100% export oriented unit duly approved vide proceedings dated 28.02.2002 under the Software Technology Park Scheme of the Government of India which was issued under the delegated power of the Directors of Software Technology Parks of India (STPI) by Inter Ministerial Standing Committee (IMSC) vide letter dated 24.06.1993.

3.There is no serious dispute in respect of the facts placed by the petitioner. The respondent-Department have also not disputed the nature of business as well as the order of approval issued by the Directors of STPI by IMSC vide letter dated 24.06.1993.

4.The issue raised is about the exemption to be granted under Section 10B of the Income Tax Act, 1961 (hereinafter referred to as “the Act”).

5.The learned counsel for the petitioner made a submission that the mandatory requirement as contemplated by the Hon’ble Supreme Court of India in the case of GKN Driveshafts (India) Ltd. vs. Income-tax Officer reported in (2003) 259 ITR 19(SC) has not been complied with. The reasons furnished are gist and not reasoned. Thus, the very initiation of reassessment proceedings under Section 147 of the Act and the notice under Section 148 of the Act and the reasons furnished are in violation of the directives issued by the Hon’ble Supreme Court.

6.It is contended that the returns filed by the petitioner were taken up for scrutiny and the Assessing Officer considered all the documents and materials made available and passed the assessment order under Section 143(3) of the Act on 31.03.2013. In the said assessment order, the income exempted under Section 10B was deducted and the benefit was extended to the petitioner. The benefit was extended based on the approval obtained by the petitioner from the competent authority, mainly the STPI. The assessee was of an opinion that the approval granted by the STPI, pursuant to the delegation of powers conferred on them by the IMSC, is valid for the purpose of claiming exemption under Section 10B of the Act. Thus, the assessee had not committed any act of suppression or omission at the time of filing of returns or at the time of scrutiny. Admittedly, the reopening of assessment proceedings are initiated beyond the period of four years and within a period of six years. Undoubtedly, if the reassessment proceedings are initiated within a period of four years, then the scope is wider. If the reassessment proceedings are initiated beyond the period of four years, then the conditions stipulated in the provisions are to be satisfied.

7.The learned counsel for the petitioner reiterated that there was no suppression or otherwise and the assessee filed returns and furnished all the details and even the reopening proceedings were not clear regarding any alleged suppression or non-disclosure and therefore, the initiation beyond the period of four years, is hit by the conditions stipulated under Section 147 of the Act.

8.The learned Senior Standing Counsel appearing on behalf of the respondent disputed the said contention by stating that the reasons stated for reopening of assessment under Section 148 reveal that “the assessee claimed an amount of Rs.3,78,00,000/- as exemption under Section 10B of the Act in respect of the export of software based on the approval of STPI/MEPZ without ratification by the Central Board of Direct Taxes (CBDT) as per the Explanation 2(iv) under sub-Section 9A of the Act”. The assessee had suppressed the fact regarding the ratification to be obtained from the CBDT which is not obtained admittedly and thus, the reopening of assessment is well within the meaning of the provisions under Section 147 of the Act.

9.The learned Senior Standing Counsel for the respondent relied on the counter statement and contended that the petitioner having failed to place sufficient materials to claim deduction during the original assessment, cannot now derive and mileage out of its own mistake. The letter dated 18.08.2016 to reopen the assessment is only a letter disclosing the brief reasons for reopening.

10.The learned Senior Standing Counsel is of an opinion that the assessee, from and out of his own mistake, is attempting to escape from the reassessment proceedings and therefore, the writ petition is liable to be rejected.

11.This Court is of the considered opinion that the respondent- Department are shifting the blame on the assessee. Whether such a stand taken beyond the period of four years can be sustained with reference to the conditions stipulated under Section 147 of the Act is the issue to be considered.

12.Let us now look into the conditions stipulated under Proviso to Section 147 of the Act, which contemplates that where an assessee under sub-Section (3) of Section 147 or Section 147 has been made for the relevant assessment year, no action shall be taken under Section 147 after the expiry of four years from the end of the relevant assessment year, unless any income chargeable to tax has escaped assessment for such assessment year by reason of failure on the part of the assessee to make a return under Section 139 or in response to a notice issued under sub-Section (1) of Section 142 or Section 148 or to disclose fully and truly all material facts necessary for his assessment, for that assessment year.

13.With reference to the counter statement filed and the arguments advanced on behalf of the respondent regarding the reasons furnished for reopening of assessment under Section 147, the respondent shifted the burden on the assessee by stating that the petitioner failed to place sufficient materials to claim deduction during the original assessment and committed a mistake. In this regard, the respondent-Department have stated that the assessee had not disclosed fully and truly all material facts.

14.The language employed in the Provision is to be interpreted constructively and pragmatically so as to understand the purpose and object. Plain meaning would not serve the purpose to meet out the object of the provision. Thus, this Court is of an opinion that the language employed under the Proviso to Section 147 i.e., “to disclose fully and truly all material facts” denotes that there must be an intention or motive on the part of the assessee to suppress certain facts at the time of passing an assessment order by the original authority.

15.Question may arise, if certain non-disclosure can be a ground for reopening. In this regard, absolutely there is no bar for reopening of assessment within a period of four years under Section 147 of the Act and if the reopening of assessment is to be made beyond four years, then it must be established that the assessee has not disclosed fully and truly all material evidence with an intention to escape from the payment of tax. Mere non- disclosure is insufficient in view of the fact that the assessee may have certain opinions in the matter of furnishing certain details to the Assessing Officer. Therefore, the motive or intention on the part of the assessee for such non-disclosure is also a material ground to be considered by the Courts as well as by the authority at the time of reopening of assessment beyond the period of four years.

16.In respect of the case on hand, undoubtedly, the assessee had not submitted the ratification certificate to be obtained from the CBDT for claiming exemption under Section 10B of the Act. However, there are certain confusions even within the Department Officials regarding production of such ratification certificate from the CBDT. The dispute arises in view of the fact that the assessee is of an opinion that the approval granted by the STPI under the delegated powers of the Directors of STPI by IMSC is a valid approval for the purpose of claiming exemption under Section 10B of the Act. Therefore, the presumption cannot be construed as suppression on the part of the assessee. It is not a mere presumption in the present case by the assessee. The presumption has got a valid reason because the assessee is holding a valid approval obtained from the STPI and the power to grant approval was delegated to the Directors of STPI by IMSC. It is not as if the assessee claimed exemption under Section 10B without any such approval. It is a case where the order of approval, which was validly granted, was produced before the Assessing Officer at the time of scrutiny and the Assessing Officer also accepted the approval order and granted exemption. Thus, the reason stated in the impugned proceedings that the assessee committed a mistake cannot be accepted. The assessee was possessing a valid approval which was produced before the Assessing Officer and if a ratification is to be obtained, then the Assessing Officer, at the time of scrutiny, ought to have directed the assessee to get any such ratification certificate for the purpose of grant of exemption under Section 10B which the Department had not done. Thus, it was a mistake or omission committed by the Assessing Officer at the time of passing of the original assessment order. Even in such cases, if the reopening of assessment is made within a period of four years, then there is a ground for the Department to reopen the same. However, in the present case, the reopening of assessment is made beyond the period of four years and therefore, the statutory requirement contemplated under Section 147 is to be complied with scrupulously. Thus, the ground taken for reopening of assessment that the assessee has not disclosed fully and truly all material facts is not established in the present case and the assessee, in fact, submitted all the particulars regarding the approval granted by the authority and further ratification, if required, must be instructed by the Department which was not done and therefore, there was no suppression or non- disclosure of material facts by the assessee. Thus, the initiation of proceedings under Section 147 of the Act, beyond the period of four years, is not sustainable and consequently, the impugned proceedings are not in consonance with the conditions stipulated in the Proviso to Section 147 of the Act.

17.Accordingly, the impugned order dated 15.11.2016, passed by the respondent-Department is quashed and the writ petition stands allowed. No costs. Consequently, connected miscellaneous petition is closed.

16.06.2021 Index : Yes Speaking Order abr To Assistant Commissioner of Income-tax, Corporate Circle-4(2), 121, Mahatma Gandhi Road, Chennai-600 034.

S.M.Subramaniam, J.

(abr) W.P.No.43662 of 2016 16.06.2021